When the UK regulator Ofgem released its 2025 compliance review, the headlines weren’t kind. Three major suppliers (Octopus, E.ON Next, and Good Energy) were obliged to pay more than £14 million in compensation for failing to issue final bills on time and refund credit balances to prepayment customers.

Based on the press coverage, customers were [quote] “frustrated” and regulators … demanding improvements to billing workflows and communication systems.”

We can suggest that for months, those suppliers scrambled to rebuild billing workflows, reprint millions of corrected invoices, and appease angry customers.

The reputational hit was severe, even though the issue wasn’t about pricing, but about compliance automation. What should have been a routine regulatory obligation turned into a public relations crisis and a financial drain.

Across Europe, similar stories are surfacing. Regulators are no longer waiting for voluntary improvements; they’re enforcing accountability through data-driven audits, cross-market oversight, and penalties that reach into the millions.

This article explains the six key EU energy regulations that every energy supplier must be ready for and why failing to align billing, settlement, and reporting workflows could mean fines, reputational damage, or loss of market access.

Without further ado, let’s dive in.

Key Takeaways

- For utilities, billing and compliance are now strategic control systems.

- Under the Energy Efficiency Directive, billing can no longer be purely consumption-based.

- The Corporate Sustainability Reporting Directive doesn’t just ask companies to report; it requires energy suppliers to prove the accuracy of every number.

- Under the EU Electricity Market Reform & REMIT II, trading and billing systems are now inseparable.

- Utilities need to update tariff engines, billing templates, and communication workflows as new tariff structures emerge to comply with the Affordable Energy Action Plan.

- The EU Hydrogen Mechanism creates an entirely new billing paradigm: suppliers must invoice not just for volume but for carbon intensity and certification status.

- AFIR is not only about installing chargers; it’s about redefining how electricity is sold, billed, and disclosed through the growing network of public charging points.

Compliance as a business function

Recent research from Marsh underscores that regulatory change has become a top-five enterprise risk for European companies. Compliance costs are now rising faster than financing costs, and enforcement actions have become more visible and punitive.

For utilities, that means billing and compliance are no longer administrative layers; they’re strategic control systems. Every invoice, tariff configuration, and audit log is potential evidence. The organisations that modernise these processes early will not only avoid penalties but also reduce volatility, lower insurance premiums, and strengthen investor confidence.

1. The Energy Efficiency Directive (EED)

The Energy Efficiency Directive (EU 2023/1791), the recast EED, is Europe’s central framework for cutting energy use and embedding the principle of energy efficiency first. It becomes binding across all member states by October 11, 2025.

For utilities, EU energy efficiency regulations are more than policies; it’s a performance contract. Suppliers and distributors must prove measurable customer energy savings, support mandatory energy audits, and document compliance through verifiable data.

That means billing can no longer be purely consumption-based. Systems must:

- Support performance-linked billing models such as pay-per-kWh-saved.

- Track and compare baselines vs. actual usage to quantify savings.

- Store audit-ready records for regulators and corporate clients.

Failure to comply with EU energy efficiency requirements can result in national penalties of up to €100,000 or daily fines. The hidden cost is worse, which is the exclusion from national energy-efficiency schemes and public loss of credibility.

2. The Corporate Sustainability Reporting Directive (CSRD)

Under the CSRD (Directive 2022/2464), more than 50,000 European companies will soon need to disclose audited ESG data under standardised European Sustainability Reporting Standards (ESRS). For energy suppliers, this covers energy intensity, emissions, and savings performance. These are the same metrics generated by billing and metering systems.

CSRD doesn’t just ask companies to report; it requires them to prove the accuracy of every number. Billing and compliance workflows, therefore, must ensure:

- Full data traceability from meter to invoice to ESG report.

- Integration with audit tools for carbon and energy disclosures.

- Version control for tariff, consumption, and emissions datasets.

Non-compliance carries tangible risks: restated ESG filings, investor downgrades, or civil liability in national courts. In a sector already under scrutiny for greenwashing, inconsistent or unverifiable data can erode investor trust in an instant.

3. EU Electricity Market Reform & REMIT II

2025 is the enforcement year for the EU Electricity Market Reform and the upgraded REMIT II (Regulation 2024/1106), designed to strengthen transparency and curb market manipulation.

Trading and billing systems are now inseparable. Regulators expect every transaction, imbalance cost, and capacity payment to be traceable from trade execution to customer invoice. Integration between trading desks, settlement modules, and billing engines is no longer optional.

Suppliers must implement:

- Automated REMIT reporting is directly linked to billing data.

- Validation workflows ensure invoices are tamper-proof and consistent with trading records.

- Instant audit trails for national regulators.

Non-compliance isn’t theoretical: Spain’s CNMC fined Gesternova and Axpo Iberia €7.5 million, and Neuro Energía another €1 million, for market manipulation under REMIT. The pattern is clear: if your billing and reporting can’t explain your trades, regulators will.

4. Affordable Energy Action Plan

Expected between Q3 and Q4 2025, the Affordable Energy Action Plan introduces variable grid charges, flexible tariffs, and forward market tools designed to shield consumers from price shocks.

Utilities will need to update tariff engines, billing templates, and communication workflows quickly and repeatedly as new tariff structures emerge.

Transparent breakdowns of regulatory fees, grid costs, and hedging components will become mandatory on bills. Billing platforms must therefore:

- Handle real-time or time-of-use pricing.

- Display detailed cost composition and consumer incentives.

- Embed compliance validation before sending invoices.

Ignoring these EU energy market regulations’ requirements invites both regulatory and consumer backlash, as UK suppliers discovered when Ofgem forced multimillion-pound compensation for billing errors tied to outdated tariff logic.

5. EU Hydrogen Mechanism

The EU Hydrogen Mechanism, launching in September 2025, will link hydrogen producers and buyers through a digital matching platform. Every contract will rely on certified purity levels and guarantees of origin.

This creates an entirely new billing paradigm: suppliers must invoice not just for volume but for carbon intensity and certification status. Systems must integrate:

- GO registries and subsidy verification modules.

- Pricing by production method (renewable, low-carbon, or transitional).

- Documentation supporting audit trails for EU state-aid compliance.

Companies that can’t align billing with certification data risk losing access to the low-carbon hydrogen market and the subsidies that underpin it.

6. The Alternative Fuels Infrastructure Regulation (AFIR)

The Alternative Fuels Infrastructure Regulation (EU 2023/1804), also known as AFIR, is the EU’s new framework that connects energy supply, mobility, and decarbonization. It entered into force in April 2024 and became fully applicable across all member states by April 2025.

For energy suppliers, AFIR is not only about installing more chargers; it’s about redefining how electricity is sold, billed, and disclosed through the growing network of public charging points.

The regulation mandates transparent, real-time pricing, open access for consumers, and interoperability between charging systems across Europe.

That means billing can no longer operate as a separate process from mobility data. Systems must:

- Support dynamic, real-time tariffs for public and roaming EV charging.

- Generate transparent invoices that show a full breakdown of energy prices, grid fees, taxes, and levies.

- Integrate Guarantees of Origin (GOs) to disclose renewable energy shares for each charging session.

- Be interoperable with smart-charging and vehicle-to-grid (V2G) systems to enable flexible load management and energy balancing.

Failure to comply with the EU EV regulations can result in administrative fines, loss of eligibility for infrastructure subsidies, and reputational damage for suppliers associated with non-compliant charging networks.

Beyond penalties, missing AFIR readiness means being locked out of one of Europe’s fastest-growing markets. This is the regulated, data-driven electric mobility ecosystem where billing transparency and energy origin disclosure are now mandatory components of trust.

Learn about MaxBill’s modern energy billing software for service suppliers:

Regulatory readiness pays off

Across all these initiatives, one truth holds: data quality equals compliance quality. Each regulation demands that billing and reporting data be complete, consistent, and verifiable.

Forward-looking suppliers treat this as a strategic investment. Automated compliance workflows and modular billing systems allow them to:

- Launch new products faster when regulation changes.

- Provide regulators with proof of compliance in days, not months.

- Use verified sustainability data to access lower financing rates.

As Marsh’s global risk research notes, firms that invest in compliance infrastructure show “higher resilience scores and lower volatility in total cost of risk.” In other words, regulatory readiness pays off.

Conclusion

Regulation sets the floor; leadership comes from going beyond it. European energy suppliers are entering an era where the ability to demonstrate transparent, auditable, and adaptive billing processes is as critical as supplying energy itself.

Those who modernise now by integrating compliance into their digital core will not only avoid fines and disruptions but also gain strategic advantage in capital markets, customer trust, and future market access.

Whatever happens in the market, agile and configurable billing and compliance workflows will ensure resilience and competitiveness in the long run.

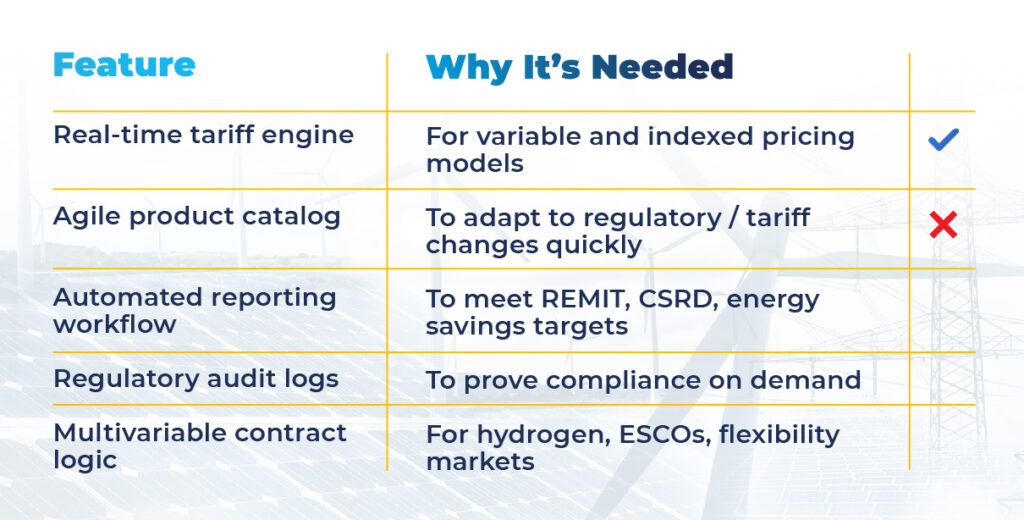

Checklist of system capabilities to comply smoothly

Below is the checklist of billing and compliance capabilities your internal systems should have to comply seamlessly with regulations. Do your assessment and be ready for the laws.

Having any questions? Contact the MaxBill team.