The debt prediction model in utilities and energy has become a crucial instrument for utilities in recognising and preempting the surge of customer indebtedness. In this financially strained landscape, it especially makes sense. Revenue protection, healthier cash flow, better financial performance – all that becomes possible after leveraging predictive technologies and their suggestions for managing “at-risk customers’.

So, in this piece, you will learn about:

- The real “debt situation” that makes us help deliver solutions to utilities

- The debt prediction tool: what it is and how it helps service providers

- Customer segmentation – does this tool work for residents and industries?

- How “What-if” simulation improves debt recovery strategies

- Scenarios as examples to understand the model in action

- Business value and outcomes for organisations

- What’s your next big step?

Now, let’s dive into the realm of the utility debt prediction model to understand how it can empower your business.

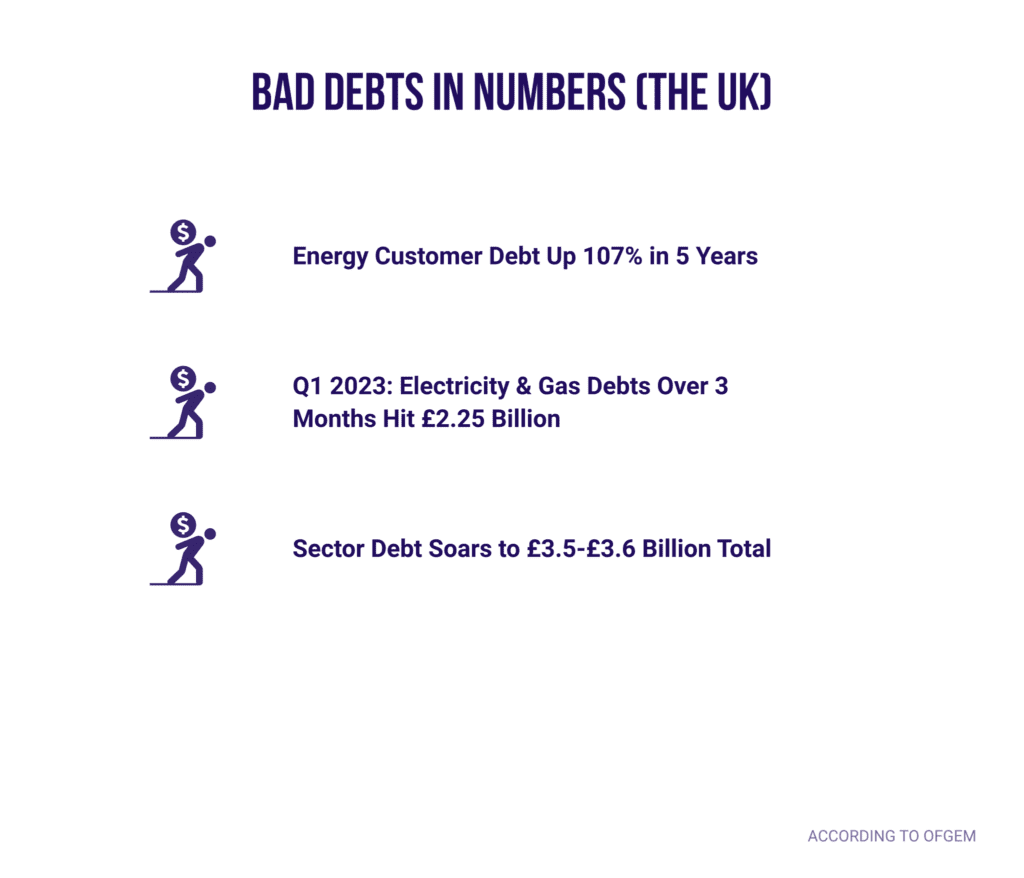

Distilling the “Debt Situation’ in the Energy Industry

Managing Bad Debts: Substantial losses from bad debts, potentially in the millions, directly impact utility cash flows and investment returns.

Consumer-Focused Strategies: Regulators urge utilities to prioritise consumer interests. Introducing measures for better customer engagement, especially with those at risk of nonpayment, can positively influence rate case outcomes.

Reassessing Deposit Requirements: Regulators are scrutinising the necessity of deposits by utilities, considering them as added burdens for customers facing financial challenges. Utilities need to explore alternative strategies for safeguarding against nonpayment.

Enhancing Bad Debt Management: Utilities earmark significant funds for bad debt write-offs, restricting their use elsewhere. Precise forecasting of arrears is key, influencing fund availability for operations, investments, and cash flow enhancement. Inadequate reserves can disrupt cash flow and receivables, necessitating fund reallocation.

In this article, we dive deeper into the critical role of the machine learning model for predicting debts. It is an indispensable tool for addressing escalating customer indebtedness. It helps safeguard revenue and foster sustainable customer relationships within the utility sector.

The Debt Prediction Model Explained

A. Operation and Parameters

As the chill of winter 2024 approaches, utility providers must sharpen their customer strategies. The machine learning model stands at the forefront of this initiative, empowering utilities to:

- Accurately identify contracts at high risk of accruing future arrears.

- Analyse key factors contributing to customer debt formation.

- Implement ‘What-If’ modelling for strategic forecasting and decision-making.

Machine learning makes it possible to gain insights into what actions have the biggest impact on collecting consumer debt. The system also provides predictions on the likelihood of success. Artificially simulating several possible action permutations helps find the action sequence that could maximise collections and bring the arrears to an earlier debt resolution.

Key Steps in the Modelling Process:

- Problem Identification and Business Understanding: Begin by addressing fundamental questions to define the project’s scope, including requirements, priorities, and budget allocation.

- Data Collection: Gather data from pertinent sources, which may be in structured or unstructured formats, to form the basis of the analysis.

- Data Processing: Undertake the crucial step of refining and processing raw data, a task vital for ensuring the quality and reliability of the project’s outcomes.

- Data Analysis: Engage in an in-depth examination to develop insights about potential solutions and to understand the variables impacting the data lifecycle.

- Data Modelling: Construct a tailored model that aligns with the project’s objectives and is designed to deliver the desired level of performance.

- Model Deployment: Implement the analysed model through the appropriate platforms and channels, ensuring it functions effectively in real-world applications

MaxBill’s ML debt prediction model is based on 70 parameters according to individual client requirements (name falls under NDA). This model offers adaptability, allowing for the expansion of parameters to align with the specific business characteristics and unique needs of each company.

Key parameters and indications of the MaxBill debt prediction model:

- Include diverse factors like payment methods, consumption patterns, service duration, and regional data.

- Payment modes (e.g., direct debit, postpaid) help assess risk propensity.

- Significant changes in service consumption or prolonged service usage can indicate potential future arrears.

- Regional data adds context, differentiating customer profiles by location.

Model’s operational mechanics:

- Based on predictive analytics, identifying anomalies in consumer behaviour.

- An abrupt increase in utility usage triggers alerts for potential issues.

- Compares anomalies against historical regional averages to identify irregularities, such as gas leaks or payment risks.

B. The Technology Stack & Implementation

The model leverages the XGBoost algorithm, a machine-learning tool adept at efficient classification, regression, and ranking, and is built on a Flask service framework. To construct a viable model, a minimum of 5,000 contracts is necessary. It’s further enhanced by advanced visualization capabilities through Power BI, providing dynamic, scenario-based visual insights. This allows decision-makers to set specific parameters, explore various ‘what-if’ scenarios, and develop strategic plans accordingly.

Additionally, the user interface (UI) of the model employs a REST API, ensuring seamless integration without the need for a full-scale billing system deployment. As for the model’s preparation and implementation, the timeline is set at 60 working days. The evaluation phase extends over three months, or it can utilise historical data for this purpose.

C. A Dual Focus: Residential and Commercial Customer Segments

While residential customers are the primary focus of these analytical efforts, the predictive analysis models also extend their predictive prowess to industrial and commercial clients. This dual approach ensures comprehensive coverage, recognising that debt risks permeate all customer classes. By applying uniform business logic and rules across the board, the models provide a balanced field of vision that acknowledges the distinct nature of each segment while fostering an environment of financial health and customer retention.

D. ‘What-if’ Simulations: Charting the Course of Action

The ‘what-if’ simulation feature leverages machine learning to explore various action sequences that can maximise debt recovery efforts and help resolve the debt as quickly as possible. By simulating a spectrum of interventions, the utility can devise strategic plans that are not just reactive but predictive, thereby transforming the landscape of debt management into one where foresight leads to better financial outcomes.

Through these advanced statistical solutions, utilities can appreciate the uniqueness of each customer’s situation, providing personalised intervention scenarios. This level of customization ensures that the solutions offered are not just effective but also empathetic, aligning with the customers’ capabilities and circumstances.

By integrating a wealth of data—from consumption patterns to external economic indicators—utilities can create targeted payment plans and proactive engagement strategies. The ultimate goal is a harmonious balance between maintaining revenue streams and supporting customers through their financial difficulties, cultivating a relationship based on understanding and trust.

Related:

Utility Debt Management With Optimised Collection Systems

Energy billing: how to help customers avoid bill complaints, debts, and blackouts

Scenarios: Understanding Dept Predictive Analytics in Action

The following are examples of possible model logic to predict at-risk contracts and simulations to tackle them:

Scenarios 1:

Contract No. 29901 has been using the company’s services for more than 3 years. The system identified the contract as a potential debtor with a probability of 90%:

- The average contract bill for the last 3 months has significantly increased compared to other contracts in the service region

- The client pays the contract invoices in cash

- The system simulated that introduced a fixed payment would lead to greater loyalty and reduce the risk of becoming a debtor to 1%.

Scenario 2:

Contract №29750 has a probability of becoming a debtor of 51%. This is an average statistical contract of a customer who regularly pays bills and has an average value of consumption for a given region of service provision.

With the help of a forecasting system, it is determined under what conditions the contract will enter the zone of risk. With an increase in consumption from 7950 to 13800 kW, the probability of becoming a debtor is 73%.

A Glimpse into the MaxBill Debt Prediction Model for Utilities

What do utilities gain from debt predictive models?

A. The Advantages

- Rapid Integration and Flexibility: Such a machine learning model for predicting debts comes with an architecture that allows for quick and seamless integration into existing systems via a RESTful API, ensuring minimal disruption to operational flow.

- Data-Driven Analysis: With the capacity to analyze customer data over any specified period, the model affords utilities a detailed and accurate assessment of risk across their customer base.

- High Accuracy: The high accuracy of predictions equates to more effective targeting of at-risk customers, enabling preventative measures to be implemented more efficiently.

- ‘What-If’ Scenario Planning: A core feature of the model is its ability to conduct ‘What-If’ simulations, providing decision-makers with a dynamic tool for detecting anomalies and assessing the potential impact of different strategies.

B. Business Value

- Revenue Protection: By accurately identifying accounts with a high risk of default, the model plays a pivotal role in mitigating bad debt and preserving the utility’s income.

- Healthier Cash Flow: With improved consumer debt management, utilities experience a more consistent and reliable cash flow, bolstering the overall financial health of the organisation.

- Regulatory Compliance and Customer Support: Predictive insights bolster proactive customer engagement, aligning with regulatory directives to prioritize consumer welfare and mitigating financial risks without relying on burdensome deposit requirements.

Final Words for Business Leaders

MaxBill’s debt prediction model comes as a stand-alone solution, besides its flagship utility billing solutions. If you are seeking a solution to enhance your debt collection efficiency proactively by forecasting and minimising bad debts and associated costs, please reach out to our team of debt prediction specialists.

Join Our Webinars and Transform Your Business Today!

Are you ready to take your business to the next level? At our exclusive webinars, MaxBill professionals share the knowledge and expertise we have for now as a B2B billing and CRM company for utilities and energy, knowledge gained visiting global Enlit-wise events, 27 years of experience in the field, and successful business cases.

Discover cutting-edge techniques, industry trends, and best practices directly from experts in the field. Whether you’re seeking to boost revenue, enhance customer satisfaction, or streamline operations, our webinars are tailored to meet your needs.

Don’t miss out on this opportunity to gain actionable knowledge and network with like-minded professionals. Join us and unlock the secrets to success!