Oil crisis at the beginning of 2020, then the COVID-19 pandemic, and now another global energy crisis – it looks like the world just can’t catch a break. The International Energy Agency (IEA) is worried that the skyrocketing electricity prices might slow down the post-pandemic economic recovery significantly, especially in China and Europe.

Though we’ve lived through a couple of crises already, this one is special. Despite its globality, the cause is different for each region. For most, it could have happened another time, as the crisis happened not as a result of a single event, but rather a combination of tendencies that were bubbling up for quite a while.

China’s Coal Shortage

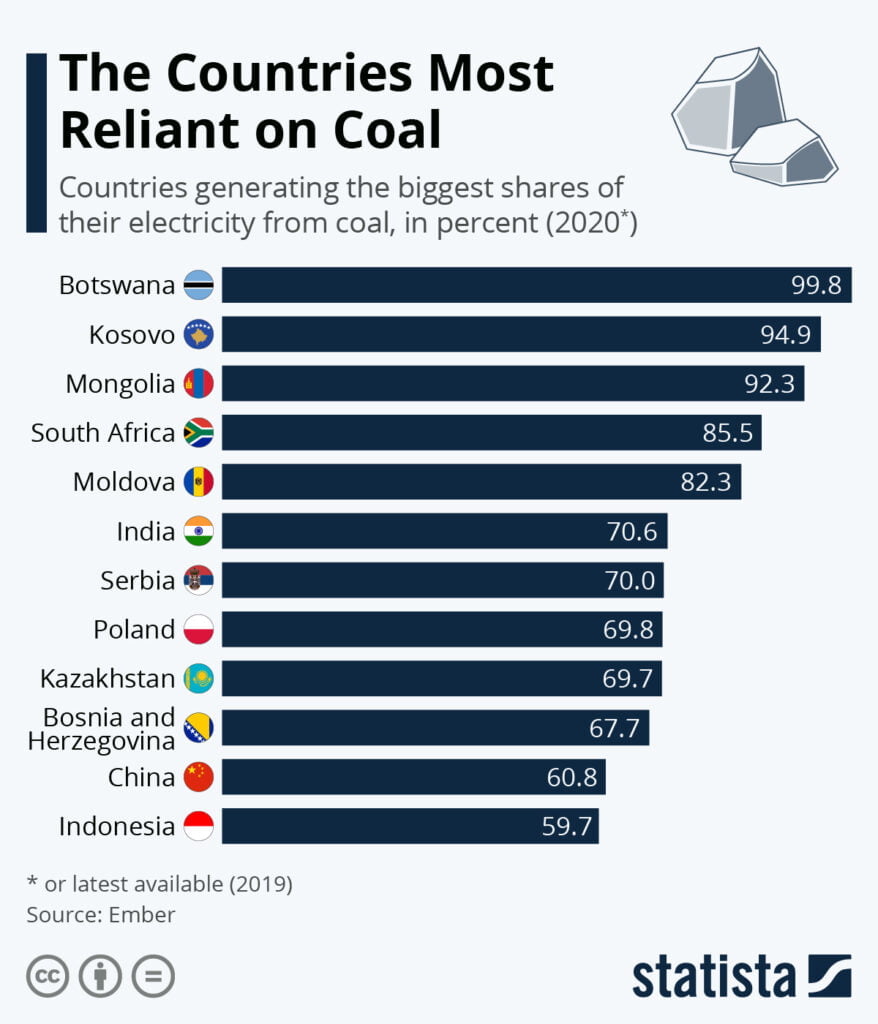

In China, the blackouts affected more than 40% of businesses and led Goldman Sachs to revise its growth forecast regarding the country. It slashed the prediction from 8.2% to 7.8% this September after China’s notable power shortages. In the second half of 2021, its coal production couldn’t satisfy even 50% of the demand. So what happened?

The economy is growing rapidly to overcome the consequences of the pandemic, which increased the electricity demand. For coal-dependent China, it means an upsurge in coal demand.

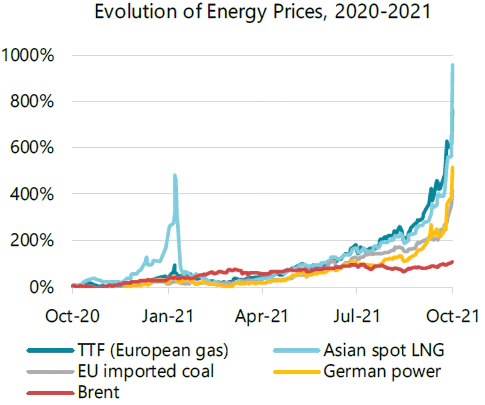

However, like many other countries in 2021, China has rethought its health and safety guidelines. The regulations for coal mines were upgraded and regional check-ups commenced, which disrupted the production process and elevated its costs. Businesses couldn’t afford the power provided by domestic coal. Providers turned to other procurement paths, but they were in for an unpleasant surprise. None of the large coal exporters could offer lower prices, as Indonesia suffered from rains, Mongolia was held off by the trucking constraints, Russia focused on Europe instead and Australia’s mines were also undergoing maintenance. To make things worse, the cost of natural gas climbed up 85% during September alone.

Europe’s Power Crunch

According to Statista, most members of the EU experienced a 21-month-long record in electricity prices this September. This situation should’ve happened – sooner or later – due to diminishing investments in oil and gas which was not compensated by the sufficient support of the alternative power sources like hydrogen, nuclear, wind or solar. The lack of attention made the industry vulnerable to force majeure. This year a variety of exceptional circumstances happened at once.

Unfortunate weather conditions

Wind activity has subsided, leaving the wind-powered plants without supply. Winter was long and cold, emptying stock at the beginning of the year, and it seems like we are about to face another long winter in 2022. At the same time, summer’s droughts have hit the hydropower plants all around the world, especially in Brazil.

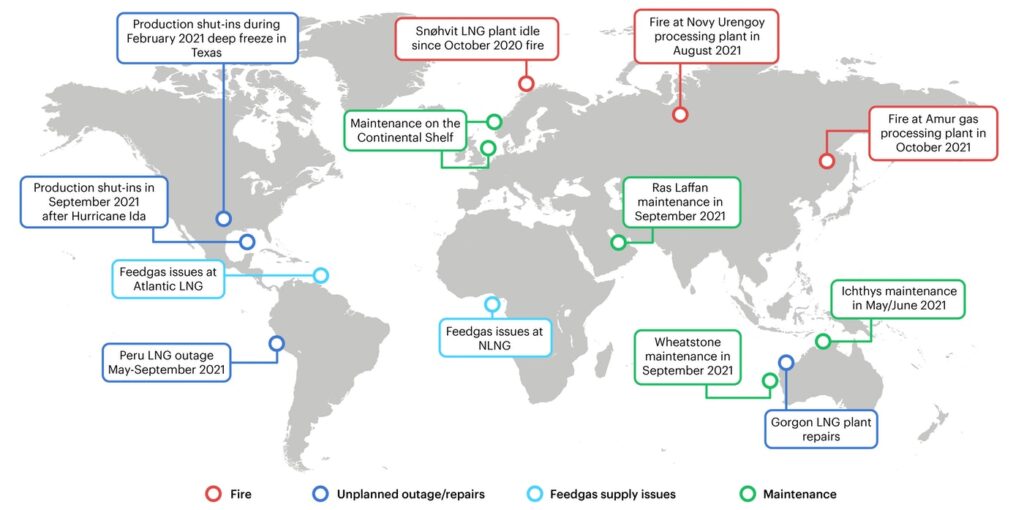

Projects pushed back due to COVID-19

More than half of the maintenance work scheduled for 2020 was shifted to 2021 because of the pandemic. This meant double pressure on assets and workers this year, which negatively influenced the supply of natural gas and coal, weighted heavily on nuclear and other alternative power plants. The UK and Norwegian areas of the North Sea Continental Shelf, LNG liquefaction plants and Ras Laffan suffered the most.

Additionally, Groningen fields in the Netherlands are planned to close in 2022 and Gazprom is too cautious to sell off its reserves. Consequently, gas provisions from the Netherlands and Russia have decreased.

Lack of trucks to transfer gasoline across the UK

The shortage of truck drivers is just one of the Brexit downsides the UK faces in 2021, but it is crucial. The country depended quite heavily on foreign drivers, and though the programs to train local professionals were set in motion, such educational initiatives were disrupted by the pandemic, leaving the UK without means of gasoline transportation. The government is currently issuing temporary visas and has put the army on standby to help out in hopes to mend the situation by holidays.

Possible Ways to Avoid Similar Crises in the Future

A popular saying goes, that there are no bad experiences – only life lessons. Let’s explore, what energy and utility professionals take away from the crisis of 2021.

Fix #1

Governments and investors offer more resources to businesses producing energy from alternative sources. Our team has explored this phenomenon in detail last year: the post-pandemic era belongs to clean power. Green energy serves a couple of purposes at once: stabilises the market and positively influences ecology at the same time, which prevents natural disasters that prove to be devastating in recent years.

Fix #2

Providers everywhere widen their supply network. Thanks to globalization, we should not depend on just two or three partners. It is time to build an international community that includes producers, providers, vendors – businesses of all sizes, including startups and independent prosumers, as well as highly engaged consumers.

Fix #3

Data analytics and forecasting are a must for most companies. It is crucial to understand how today’s trends will influence the future of the industry and what consequences might current events bring. There are loads of data nowadays that are left unused, and this has got to change if we want to make decisions based on the possible future.

All of the above can help us prevent future energy issues or withstand them if the energy and utility professionals act together. However, there are many more ways in which we can ensure our industries’ success. As an active member of the community, MaxBill is always there to join the conversation. Contact us or get in touch during the Enlit, one of the biggest energy and utility exhibitions, to learn more.