In 2026, Excel-based manual billing is still a go-to solution for many growing energy and utility companies. There are good reasons for that. It is familiar. There’s no upfront investment and no IT infrastructure to manage. You can start billing customers within hours of launching your business.

But here’s what happens next. Once growing from 50 customers to beyond 1000, most small utility operators hit the wall. The Excel files can’t keep up. Billing cycles get delayed. Errors become frequent. The team spends more time fixing mistakes than processing new customers.

We’ve seen this at MaxBill. To address the problem, we’re explaining how to transition from Excel calculations to an automated billing solution without a heavy IT project and staff increase.

We will also debunk this “it’s too expensive for our size” myth, since automated billing software does not mean enterprise-size software by default with related pricing.

The article is helpful for greenfield companies (start-ups), small but growing ones, and even large utilities and energy service providers launching new business lines.

Without further ado, let’s start.

Key takeaways

- Excel-based billing makes companies ‘vulnerable’ with customer growth, need for more complex billing logic, tariff management, and one source of truth.

- Manual billing decreases receivables discipline and brings operational, financial, and compliance risk.

- Enterprise-size fit-for-all myth debunked: you pay zero until you have proven business viability of €300K in billing (as part of AI-powered billing).

- Migration does not mean ops disruption: Billing runs in parallel with your current system.

- You get automatic invoice calculation, no data chaos, error drop by 99%, predictable revenue and stable cashflow, secure business continuity and growth capacities.

Why should manual billing be ‘reconsidered’?

Easy at the beginning, hard to unwind

Excel is familiar and accessible. Early on, it feels faster than evaluating billing software. Over time, the original spreadsheet quietly becomes a mission-critical system that no one feels confident about replacing. But should you grow your customer base and bill them in time, things fall apart.

No IT or delivery capacity

Small teams juggle customer support, operations, and finance. There’s rarely internal expertise or budget to assess, implement, and maintain a billing platform, so Excel remains the default by necessity rather than choice.

Human-dependent billing logic

Pricing rules, exceptions, and calculation logic often live in the heads of one or two people. When knowledge is personal rather than systematic, the organisation becomes vulnerable to absence, turnover, or simple oversight.

Fragmented data landscape

Customer records, meter readings, tariffs, and adjustments are stored in separate files or received via email. Billing depends on manual consolidation across multiple sources, increasing effort and risk at every cycle.

No audit trail or traceability

Excel doesn’t record who changed what or why. Reconstructing historical invoices or explaining billing decisions during disputes or audits becomes unreliable or impossible.

Fragile tariff logic

Commercial rules are translated into formulas that must be manually created and maintained. As tariffs evolve, complexity increases faster than control, making errors difficult to detect and prevent.

These aren’t just operational inconveniences. They create real business problems that are compounded over time.

Impact on daily ops and business outcomes

Let’s talk about what a manual billing process looks like in practice and what it ultimately leads to.

Operational drag and error amplification

Invoice preparation becomes a repetitive, manual exercise: collecting readings, aligning customer data, applying formulas, and checking outputs. A single mistake, and you get an outdated rate; a wrong cell reference can affect hundreds of invoices. Each error triggers investigations, corrections, reissued bills, and customer communication. This multiplies effort well beyond the original mistake.

Receivables discipline decrease

Billing delays, inconsistent invoicing, and ad-hoc reminders weaken payment discipline over time. When invoices arrive late or corrections become routine, customers learn that payment urgency is negotiable.

Accounts receivable grow not because customers refuse to pay, but because the company lacks a systematic, enforceable billing and notification cycle. Cash-flow forecasting becomes unreliable. This limits financial planning and investment decisions.

Limited decision-making and compliance exposure

Answering basic management questions, such as revenue by period, consumption trends, or customer segments, requires manual aggregation across files. As a result, insight generation is slow and often deprioritised.

Regulatory and statutory reporting adds further pressure: data must be consolidated manually, verified repeatedly, and explained without a clear audit trail. This increases the risk of reporting errors, audit findings, or regulatory scrutiny.

Growth, continuity, and risk concentration

Manual billing systems do not scale predictably. As customer numbers grow, complexity increases faster than capacity. Dependency on individuals, lack of enforced logic, and absence of systematic controls make quality unpredictable.

Errors become unavoidable rather than exceptional. This creates a concentration of operational, financial, and compliance risk that limits growth and exposes the business to disruptions it cannot easily absorb.

Why small companies fear switching from manual billing

Despite these problems, many small companies hesitate to change. The barriers feel real. We distilled the top 5 fears stopping company leaders from purchasing an automated billing system:

- “It’s too expensive for our size.” They think it’s enterprise-like: heavy implementation, long-term contracts that lock them into expensive commitments. In reality, the MaxBill modern billing solution is perfect for small energy and utility companies to actually get started: there’s no upfront cost; you pay zero until you have proven business viability of €300K in billing. Costs scale proportionally with your revenue.

- “Our team won’t be able to handle it.” A learning curve exists everywhere. The question is how much time and upskilling it requires. With the MaxBill billing approach, business users access the system, onboard customers, create packages, do modifications with simple prompts that AI picks up and executes tasks for them.

- “We don’t have technical specialists.” The MaxBill billing system is designed for business teams. All configuration, tariff changes, and product updates are done through simple prompts in Edit Mode, not coding or system scripting. Most suppliers go live in weeks with zero IT involvement.

- “We’re too small, we don’t need this.” Small companies actually benefit most from automation. When you have limited staff, every hour matters. Automation gives small teams leverage, which is the ability to handle much larger customer volumes without proportional increases in headcount.

- “Migration will disrupt our operations.” Migration to the MaxBill billing solution is designed to be non-disruptive. We run it in parallel with your current system until everything is validated. Data is mapped and checked automatically, so there’s no downtime and no interruption to daily operations. Most customers switch over in a controlled, low-risk rollout without any impact on billing cycles.

Key takeaway here: the real barrier isn’t technical or financial. It’s psychological. Change feels risky when the current system, despite its flaws, is familiar. But the risk calculation is backwards. The biggest risk small operators face is staying with systems they’ve outgrown while their business continues to grow around them.

Now, let’s get to the very transition from manual billing to an automated one and what it implies for your company.

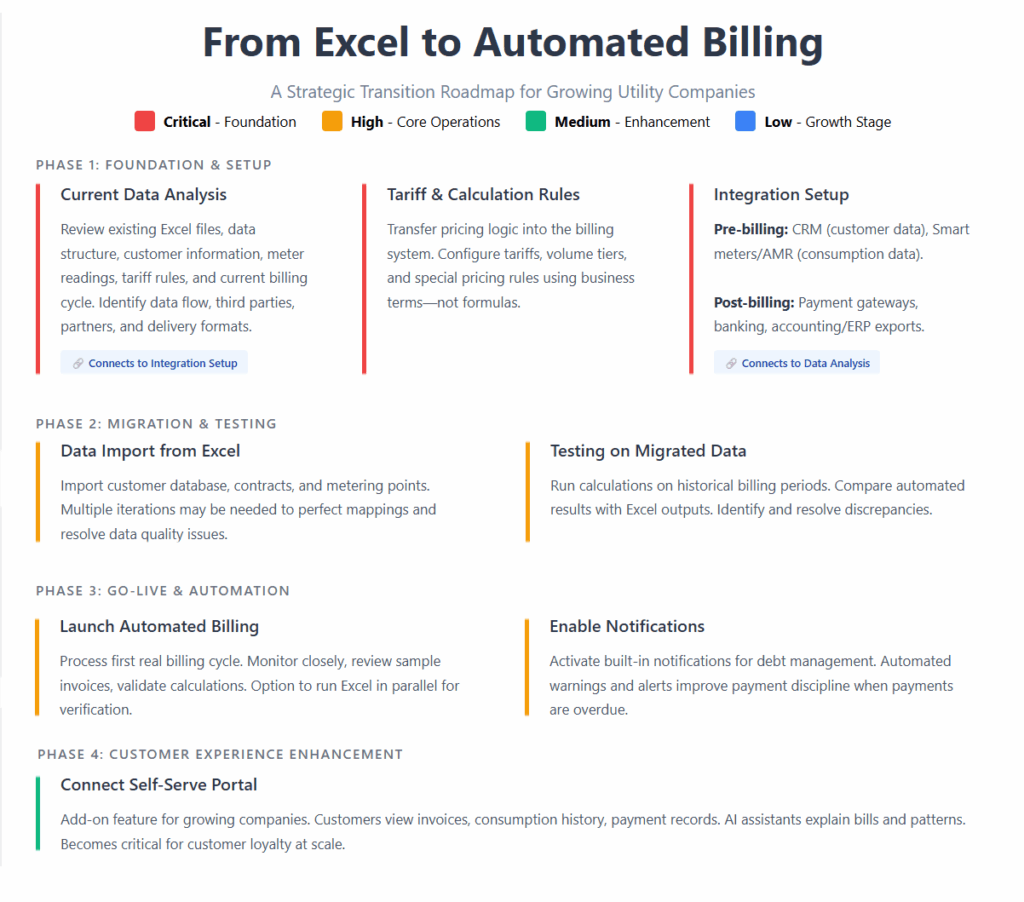

The transition process: from Excel to automated billing

Here’s what happens when a growing utility company moves from Excel to automated billing:

What small operators gain after automation

The change is immediate and tangible.

Automatic invoice calculation gives you time back

Billing cycles that once consumed days now complete in hours. Calculations, tariff logic, and invoice generation run automatically, without manual intervention. The team no longer builds spreadsheets; they review exceptions and handle customer questions. Billing becomes a predictable process instead of a recurring operational project.

A single source of data eliminates file chaos

All customer data, consumption history, tariffs, and invoices live in a single system. Everyone works from the same records, and every report pulls from the same source. There is one definitive version of the truth, which simplifies internal coordination and makes audits and inspections far easier to handle.

Error rates drop by 90-99%

Automated billing removes the most common sources of errors: manual formulas, copy-paste mistakes, and missed updates. Tariff rules apply consistently, and data is validated before invoices are issued. As a result, billing errors typically drop by 90–99%, along with the operational cost of corrections, refunds, and customer complaints.

Revenue becomes transparent and predictable

Revenue visibility improves immediately. You can see what has been billed, what has been paid, and what remains outstanding in real time. Cash-flow forecasting becomes reliable, and profitability by tariff or customer segment is no longer guesswork. Financial planning shifts from retrospective spreadsheet analysis to forward-looking, data-driven decisions.

Reporting happens in seconds, not days

Reporting stops being a recurring disruption. Standard management and regulatory reports are generated instantly, using current data. Quarterly and annual reporting periods become routine administrative steps instead of high-stress, error-prone exercises.

Regulatory compliance becomes built-in

Audit trails are created automatically for every calculation and change. Any invoice can be reconstructed months or years later, with full transparency. Customer disputes are resolved more quickly, and regulatory requests are handled with confidence because the underlying data is complete and easily traceable.

Business continuity no longer depends on unique people

Billing logic lives in the system, not in individual memory. New staff can be onboarded quickly, absences no longer disrupt operations, and turnover does not put the business at risk. This alone removes a major source of operational fragility for small teams.

Growth becomes possible without proportional hiring

Automation breaks the link between customer growth and staffing growth. A team that struggled to bill 1,000 customers manually can manage several thousand without expanding its headcount. Billing capacity becomes less of a constraint, making growth opportunities more achievable rather than risky.

Key takeaways here: Small teams typically save 40–60% of the time previously spent on billing. Customer support load drops as self-service and accurate invoices reduce routine queries.

Payment discipline improves through consistent billing and reminders. Revenue per employee increases because the same team can serve more customers without added risk.

These changes are visible within the first billing cycle, not months later.

Your next step

Excel is an effective starting tool. It helps small utility businesses get off the ground quickly. But it was never designed to run growing, regulated operations. It supports individual work, not controlled, repeatable business processes.

At a certain scale, automation stops being an upgrade and becomes a requirement. Manual billing no longer just slows you down, it introduces compounding risk: revenue leakage through errors, regulatory exposure from missing audit trails, operational fragility caused by key-person dependency, and growth constraints that quietly cap your business.

The good news is that this problem is solvable. Modern billing platforms are built specifically for small operators with lean teams. They don’t require heavy IT involvement, long implementation projects, or complex configuration. Automation can be introduced incrementally, with a visible impact in the first billing cycle.

The next step isn’t a technology decision. It’s an operational one: deciding whether billing remains a source of risk, or becomes a controlled, reliable function that supports growth.

If you’d like to explore what that transition could look like for your business, we’re happy to discuss it. Reach out to our team!