Updated 20 October 2025

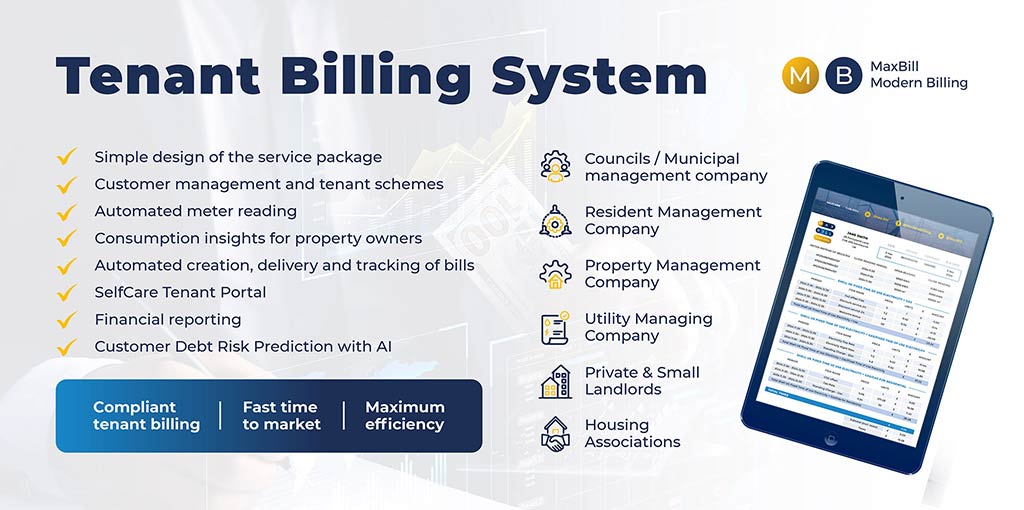

MaxBill service charge software for housing associations is successfully used by management companies in the UK and other European countries. In this piece, we decode what makes the ultimate billing system for housing associations in the United Kingdom.

The housing association service charge software with robust billing capabilities may be an icebreaker when the organisation strives to deliver better, more, and faster.

The biggest challenge of housing associations nowadays is maintaining their traditional social purpose while adapting to a changing economic landscape and increased political pressure to deliver more homes and services. The second part suggests increasing their financial and development capacity, which goes beyond their traditional charitable activities.

This means that the billing software for housing associations should not just cover a basic social housing model. It should ‘accompany’ housing associations with various business models that include non-core activities and revenue management of private rented sector (PRS) returns.

A key point here: this kind of billing goes far beyond charging and invoicing in time; it encompasses partner management; the full spectrum of contract fulfilment, compliance dictating the rules of tenant billing and customer interaction, and so on.

Keep reading as we dive into:

- The ins and outs of billing for tenants, homeowners, and commercial tenants

- Automation as part of efficient billing across the organisation

- Support of any contract fulfilment

- Tenant experience with digital services via a virtual CSR and self-service portal

- Billing covering non-core business activities

- Billing serving local business models and further transitions (e.g., mergers)

- Working with supply chain partners within one billing system

- Debt management for a healthier financial environment

- Execution of value-for-money metrics and reporting

- Compliance

- Implementation of such solutions.

“Nuanced Billing” for Tenants and Homeowners. What requirements should housing association service charge software meet?

The number one priority of housing associations is residents who need social housing. They need a clear bill consistent with time and factoring in conditions defined by the organisation or government.

The modern housing association service charge software with a powerful billing system should cover the following conditions:

- different rent payments and schedules (monthly, weekly)

- possibility of switching to direct debit

- service charges, based on the agreement type (the cost of your routine property-specific services, buildings insurance, and management fees.)

- bedroom tax, if applicable

- benefit cap, if applicable

- Universal Credit (now, replacing six existing benefits)

- Other benefits and conditions.

Automation as a Must within Software for Housing Associations

Billing scenarios are different, and all can be automated for all properties of housing associations. With a comprehensive housing association service charge software, providers can efficiently manage billing schedules, service costs, and financial adjustments, ensuring accuracy and transparency.

In fact, any business process that’s lagging can be automated. Therewith, automation includes:

- charging based on the types of people living in there: residents, leaseholders, shared owners, and freeholders

- the property type

- the services provided to the building or estate

- the lease terms agreed upon at move-in

- incurring discrepancies between billed amounts and actual expenditures

- credits for the surplus or additional charges for the deficit

- special conditions, like excluding individual home services like heating or TV licences.

The billing process within housing association software also includes estimations of the individual components of these charges for the upcoming year based on previous years’ data. Furthermore, charging comprises specific areas that require more or less expenditure.

Service Charge Software for Housing Associations with Any Type of Contract Fulfilment

Modern service charge software for housing associations executes the full spectrum of contract fulfilment when selling property (not only renting out). The contract agreement support includes the following processes:

- Equity loans coming from a housing association or through schemes like Help to Buy

- Schemes for selling homes: shared ownership or home equity scheme, right-to-buy, right-to acquire or voluntary purchase grant (incl., discounts based on the schemes)

- Additional charges for homeowners, based on the type of ownership, like net rent or ground rent; and partnership agreements.

The homeowners’ rights and responsibilities, as well as the conditions for buying, selling, and using their homes, vary widely based on the type of ownership and the specific terms of their agreements. Modern software for housing associations with powerful billing is tailored to these nuances, which is essential for fulfilling any contract related to homeownership effectively.

Positive Tenant Experience with Digital Service via Virtual CSR and Self-Service Portal.

The core mission of every housing association is to ensure a positive tenant experience. To achieve this, many associations are now adopting automated technologies and delivering a digital tenant service.

An exemplary application of this approach is the deployment of virtual Customer Service Representatives (CSRs) and the delivery of self-service portals. These virtual assistants help reduce the load on call centers and provide comprehensive information to customers. Self-service portals enable tenants to access up-to-date resident and asset information, details about their energy consumption, rent, and service charges.

At MaxBill, we deliver both. A Virtual CSR is a sophisticated chatbot powered by Generative AI. It is designed to comprehend customer queries through a series of guiding questions. Integrated with MaxBill and OpenAI via API calls, this chatbot can perform live actions during interactions. Currently, Virtual CSR supports the following functionalities:

- Generate Financial Reports: Upon request, the Virtual CSR can produce a financial report detailing payments, receipts, and invoices.

- Update Meter Readings: The Virtual CSR can update meter readings in the system upon request.

- Bill Tracing: Customers can upload an invoice as a PDF into the chat, which the Virtual CSR can parse to provide detailed information about the invoice.

The chatbot is a great tool for resident-facing teams within local housing associations.

Billing Covering Non-Core Value-Added Activities, inc. Commercial Tenants

Besides core business, advanced billing solutions empower housing associations to run and bill effectively other value-adding activities strategically focused in areas with a high concentration of homes. These activities traditionally encompass housing-related support contracts, properties for sale as part of mixed-income, mixed-tenure schemes, including retirement living, market sales aimed at generating profit; market rental properties; social care and care homes; and commercial units.

Commercial spaces

Most housing associations are committed to fostering vibrant local communities. To achieve this point of their vision, they are expanding their commercial portfolio by developing new spaces on the lower floors of many residential blocks. These units accommodate a diverse array of businesses, including shops, cafes, restaurants, workspaces, colleges, nurseries, and medical practices.

Modern tenant billing which includes CRM, revenue settlement, and partner management, allows for regulating financial relationships between housing associations, small business owners, and sole traders who have strong connections to the local community.

Additionally, housing officers or property management officers can effectively manage the customer base that includes individuals and businesses renting garages and commercial buildings, as well as those purchasing homes for outright sale.

Billing Covering Local Operating Business Model and Any Transition Planned

Whatever the business model a housing association operate by, billing solutions should cover its specifics. For example, in a mixed-funding model, associations borrow from private lenders and set rents closer to market levels. Together with it, housing benefits continue to underpin market rents.

Cross-Subsidy Model

To address funding shortfalls and reduce reliance on grants, many housing associations adopted a cross-subsidy model that suggests shared ownership. This model generates capital receipts from first-tranche sales and uplifts when shared owners ascend to full ownership, reducing long-term debt reliance.

Developing properties for sale at market prices helps subsidise the provision of affordable and social housing. Expanding into non-core activities like care provision, employment initiatives, and market rentals generates additional income streams.

In Case a Housing Association Merges into a Group Structure Model

Responding to funding pressures and the need for scale, many housing associations have pursued mergers and group structures. Mergers create larger organisations capable of reducing costs and increasing development capacity.

Independent associations form groups to pool resources, share services, and enhance financial stability. This model includes joint ventures, procurement consortia, and private/public partnerships.

Nowadays, billing solutions come with robust partnership management that can effectively serve the goals of the group structure business model.

Environmental, Social, and Governance (ESG) Finance

As the world cares about the climate and environment, so do the regulators of the housing sector, launching ESG criteria for housing associations. Thus, they increasingly focus on attracting ESG-related investments to achieve ESG performance, decarbonisation, and safety.

The thing here is that everything should be compliant with relevant regulations, incl., contract activities, etc., which is also a prerogative of an efficient billing system.

Last but certainly not least, what if a housing association operates on a circular business model?

Circular Business Models in Social Housing Associations

Circular business models in social housing associations focus on sustainability by reusing resources, reducing waste, and creating economic, environmental, and social value, distinguishing them from more traditional, grant-dependent, or purely profit-driven business models. They include:

- Delivering a service (like housing) rather than a product, ensuring all living requirements are met through one contract, with buildings remaining in the ownership of builders.

- Extending Product Value: Reusing locally existing demolition materials to reduce costs and collaborate with builders and demolition companies.

- Classic Long-Life: Providing durable housing that allows communities to stay longer, using modular design principles to enhance longevity and sustainability.

- Encouraging Sufficiency: Promoting circular lifestyles among communities by facilitating shared spaces and providing necessary technologies and coaching.

- Extending Resource Value: Selling reclaimed materials from demolition on the market.

- Industrial Symbiosis: Creating platforms for different parties to share resources and knowledge, leading to cost reductions and new project development.

- Outsourcing Circularity: Housing associations focus on affordable housing while demanding circular practices from their supply chain partners.

Housing associations with a circular business model need powerful contract fulfilment in place, partner management, and service and operational excellence to deliver on their vision and mission.

Interacting with Supply Chain Partners within One Service Charge Software for Social Housing

Service Charge Software for Social Housing enables seamless collaboration with supply chain partners by centralizing cost management, automating transactions, and ensuring transparency in financial operations.

Housing associations procure products and services from various businesses, adhering to the policies set by the Regulator of Social Housing (RSH). Effective management of responsible supply chain partners is crucial, requiring advanced partner management capabilities.

Modern billing solutions, rooted in the telecommunications sector, offer robust partner management expertise. These solutions support housing associations in developing financial and partnership models, whether delivering additional services through third-party businesses or exploring new investment opportunities.

Moreover, efficient partner management becomes particularly significant during mergers, ensuring seamless integration and operational efficiency.

Debt Management for a Healthier Financial State

The debt in housing associations is caused by many factors. These are borrowing to cover costs, loss of development and sales income, inefficiencies, rising operational costs, regulatory failures, government policies, market conditions, environmental standards, and lack of public and government support.

Housing leaders can pinpoint internal factors for escalating debts, such as substantial costs incurred from addressing fire safety issues due to regulatory failures leading to unsafe buildings.

To address these challenges, housing associations can leverage advanced billing systems that prioritise efficient debt management. For instance, positive rent settlements create a stable financial environment by providing more predictable and supportive revenue streams.

From a resident’s perspective, the debt management and collections system can be arranged this way. First of all, these are integral components of tenant billing software. This system provides property managers with a modern, adaptable solution to implement customer-friendly debt collection strategies for increasing bills.

With this advanced solution, housing officers are empowered to create multiple, customisable workflows for managing debt. These workflows can be tailored to different schemes, customer segments, and intervals, all based on specific business rules.

The flexibility of the system allows for variations in workflows to accommodate the unique needs of both residential and commercial customers.

Additionally, housing associations can enhance efficiency through digitization and other cost-saving measures, though opportunities for substantial savings may be limited.

Partnerships and mergers, facilitated by modern billing solutions with comprehensive revenue management, are potentially delivering cost savings and operational efficiencies.

Value for Money Metrics Execution And Performance Reporting

On February 15, 2024, the Regulator of Social Housing released its value-for-money metrics and reporting for 2023. Assessing and achieving ‘value for money’ involves minimizing costs, maximizing outputs, and achieving desired outcomes. An efficient billing system can help track and control costs (economy), improve operational efficiency, and ensure services meet residents’ needs (effectiveness).

What’s more, it can deliver financial forecasting and sensitivity analysis. Accurate financial forecasts depend on reliable data. At MaxBill, for example, we have client data to feed our AI and ML models to create realistic forecasts, conduct sensitivity analyses, and deliver suggestions, helping to predict and prepare for various financial scenarios. Therefore, financial forecasting for a housing association is possible once the team gets specific requirements and business needs conveyed from the organisation.

Transparent and accurate billing systems can report on the following metrics to improve stakeholder communication and ensure a clear understanding of the housing association’s financial position and performance:

- Financial ratios

- Actual costs versus budgeted costs

- Net surplus

- Operating surplus

- Minimum net surplus

- Debt per unit

- Unit costs, including:

- Rent per property per week

- Reactive maintenance

- Cyclical maintenance

- Major repairs (including capitalised costs)

- Management costs per unit

- Loan covenants

- Other financial reports.

Compliance with Financial Regulations and Standards

Ensuring compliance with financial regulations and standards is essential. Efficient billing systems help housing associations meet the regulator’s requirements for robust financial forecast and planning, risk management, and performance monitoring.

By addressing these areas, an efficient billing system can significantly contribute to the overall financial health, operational efficiency, and strategic success of housing associations.

Let’s Talk about Implementation!

Housing associations can enhance their current operations by integrating their existing asset management, CRM, ERP, payment solutions tailored for housing associations, and other essential software like Yardi, Stripe, RealPage, MRI with advanced billing systems.

At MaxBill, our billing system integrations are designed to be highly configurable and flexible, ensuring they meet the unique needs of each property organisation. This allows housing leaders to maintain seamless synchronisation across all systems, optimising overall efficiency and performance.

Are you looking to level up your billing capacities to meet your organisation’s strategic goals? Let us know how we can help you as MaxBill robust billing solutions can cover specific aspects of your core and non-core business activities, help with customer and partner management, and contribute to a more secure cash flow and revenue protection.

Housing Association Service Charge Software FAQ

What is a service charge, and why do housing associations need housing association service charge software?

A service charge is the cost of maintaining a property, including repairs, cleaning, insurance, and other communal services. Housing association service charge software automates billing, ensures accurate calculations, manages different ownership types, and provides transparency for tenants and landlords

What features should modern service charge software for housing associations include?

According to MaxBill, essential features include multiple billing cycles (weekly, monthly), automatic calculation based on tenant type, shared ownership support, cost allocation for services and insurance, and handling of benefits like Universal Credit. The right service charge software for housing associations ensures accuracy and reduces manual work.

Can MaxBill handle both residential and commercial tenants?

Yes. Service charge software for housing associations like MaxBill supports multiple business models: rental tenants, shared ownership, leaseholders, and commercial tenants. This allows associations to manage all tenant types in one platform.

How does housing association service charge software improve tenant experience?

MaxBill provides self-service portals and AI-driven support, allowing tenants to access invoices, view service charge statements, submit meter readings, and check billing history online. Using housing association service charge software increases transparency and satisfaction.

Can the software help with debt management and arrears recovery?

Absolutely. MaxBill offers tools for managing arrears, automating reminders, and setting up flexible debt recovery processes. The right service charge software for housing associations helps associations maintain financial stability while keeping tenants informed.