Updated: October 3, 2025

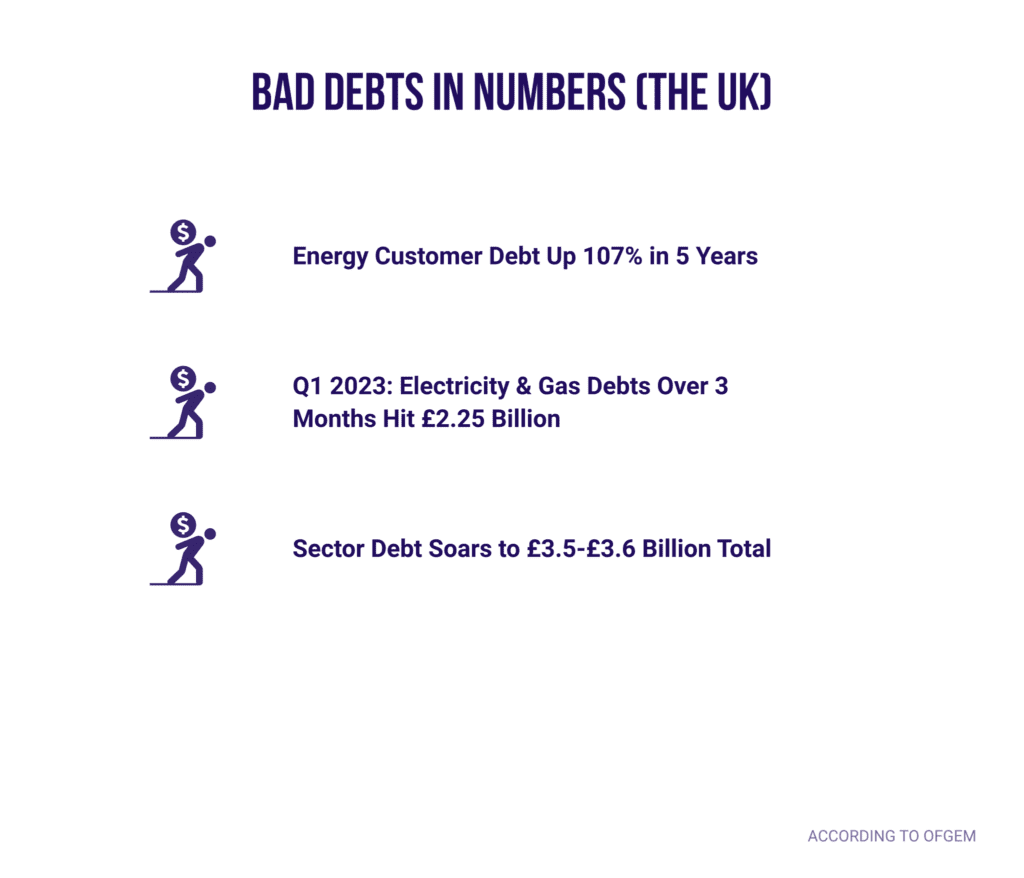

A web-based debt collection software for utilities with debt collection predictive analytics and machine learning can change the situation with bad debts and unhappy customers.

At MaxBill, we developed debt predictive ML models designed to address utility bad debts. They help CFOs protect revenue, achieve healthier cash flow, improve financial performance, decrease churn rate, etc.

In this piece, we’ll dive into the ins and outs of this debt predictive model and explore how it changes financial outcomes for organisations.

Let’s get started!

Key takeaways

- Debt collection predictive analytics enables utilities to analyse and proactively prepare for potential debt risks.

- The debt prediction model identifies “debt-risk” contracts, key factors adding to this, and potential scenarios to prevent debts and create a win-win for utilities and customers.

- The ML-based ‘what-if’ simulation explores various action sequences that can maximise debt recovery efforts and help resolve the debt as quickly as possible.

- The high accuracy of predictions equates to more effective targeting of at-risk customers, enabling preventative measures to be implemented more efficiently.

- Predictive insights align with regulatory directives to prioritise consumer welfare and mitigate financial risks without relying on burdensome deposit requirements.

Utility debt collection predictive analytics

Debt collection predictive analytics enables energy and utility companies to analyze and proactively prepare for potential debt risks. Early insights help reduce debts and save time and resources in the collection process. The use of ML algorithms significantly accelerates and simplifies utility debt collection efforts.

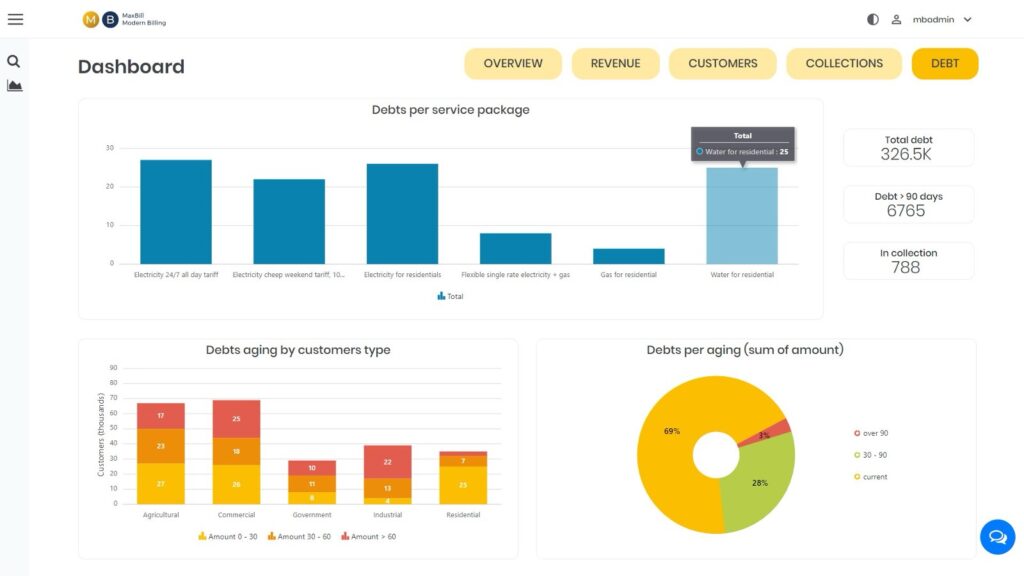

MaxBill Dashboard with information on a collection of utility debts

The debt prediction model explained

A. operation and parameters

As the chill of winter 2025 approaches, utility providers must sharpen their customer strategies. The machine learning model stands at the forefront of this initiative, empowering utilities to:

- Accurately identify contracts at high risk of accruing future arrears.

- Analyse key factors contributing to customer debt formation.

- Implement ‘What-If’ modelling for strategic forecasting and decision-making.

Machine learning makes it possible to gain insights into what actions have the biggest impact on collecting consumer debt. The system also provides predictions on the likelihood of success. Artificially simulating several possible action permutations helps find the action sequence that could maximise collections and bring the arrears to an earlier debt resolution.

Key steps in the modelling process:

- Problem Identification and Business Understanding: Begin by addressing fundamental questions to define the project’s scope, including requirements, priorities, and budget allocation.

- Data Collection: Gather data from pertinent sources, which may be in structured or unstructured formats, to form the basis of the analysis.

- Data Processing: Undertake the crucial step of refining and processing raw data, a task vital for ensuring the quality and reliability of the project’s outcomes.

- Data Analysis: Engage in an in-depth examination to develop insights about potential solutions and to understand the variables impacting the data lifecycle.

- Data Modelling: Construct a tailored model that aligns with the project’s objectives and is designed to deliver the desired level of performance.

- Model Deployment: Implement the analysed model through the appropriate platforms and channels, ensuring it functions effectively in real-world applications

MaxBill’s ML debt prediction model is based on 70 parameters according to individual client requirements (name falls under NDA). This model offers adaptability, allowing for the expansion of parameters to align with the specific business characteristics and unique needs of each company.

Key parameters and indications of the MaxBill debt prediction model:

- Include diverse factors like payment methods, consumption patterns, service duration, and regional data.

- Payment modes (e.g., direct debit, postpaid) help assess risk propensity.

- Significant changes in service consumption or prolonged service usage can indicate potential future arrears.

- Regional data adds context, differentiating customer profiles by location.

Model’s operational mechanics:

- Based on predictive analytics, it identifies anomalies in consumer behaviour.

- An abrupt increase in utility usage triggers alerts for potential issues.

- Compares anomalies against historical regional averages to identify irregularities, such as gas leaks or payment risks.

B. The technology stack & implementation

The model leverages the XGBoost algorithm, a machine-learning tool adept at efficient classification, regression, and ranking, and is built on a Flask service framework. To construct a viable model, a minimum of 5,000 contracts is necessary. It’s further enhanced by advanced visualization capabilities through Power BI, providing dynamic, scenario-based visual insights. This allows decision-makers to set specific parameters, explore various ‘what-if’ scenarios, and develop strategic plans accordingly.

Additionally, the user interface (UI) of the model employs a REST API, ensuring seamless integration without the need for a full-scale billing system deployment. As for the model’s preparation and implementation, the timeline is set at 60 working days. The evaluation phase extends over three months, or it can utilise historical data for this purpose.

C. A dual focus: residential and commercial customer segments

While residential customers are the primary focus of these analytical efforts, the predictive analysis models also extend their predictive prowess to industrial and commercial clients. This dual approach ensures comprehensive coverage, recognising that debt risks permeate all customer classes.

By applying uniform business logic and rules across the board, the models provide a balanced field of vision that acknowledges the distinct nature of each segment while fostering an environment of financial health and customer retention.

D. ‘What-if’ simulations: charting the course of action

The ‘what-if’ simulation feature leverages machine learning to explore various action sequences that can maximise debt recovery efforts and help resolve the debt as quickly as possible. By simulating a spectrum of interventions, the utility can devise strategic plans that are not just reactive but predictive, thereby transforming the landscape of debt management into one where foresight leads to better financial outcomes.

Through these advanced statistical solutions, utilities can appreciate the uniqueness of each customer’s situation, providing personalised intervention scenarios. This level of customisation ensures that the solutions offered are not just effective but also empathetic, aligning with the customers’ capabilities and circumstances.

By integrating a wealth of data—from consumption patterns to external economic indicators—utilities can create targeted payment plans and proactive engagement strategies. The ultimate goal is a harmonious balance between maintaining revenue streams and supporting customers through their financial difficulties, cultivating a relationship based on understanding and trust.

Learn about MaxBill debt prediction model:

Related:

Utility Debt Management With Optimised Collection Systems

Energy billing: how to help customers avoid bill complaints, debts, and blackouts

Scenarios: understanding the utility ML debt recovery model in action

The following are examples of possible model logic to predict at-risk contracts and simulations to tackle them:

Scenarios 1:

Contract No. 29901 has been using the company’s services for more than 3 years. The system identified the contract as a potential debtor with a probability of 90%:

- The average contract bill for the last 3 months has significantly increased compared to other contracts in the service region

- The client pays the contract invoices in cash

- The system simulated that introducing a fixed payment would lead to greater loyalty and reduce the risk of becoming a debtor to 1%.

Scenario 2:

Contract №29750 has a probability of becoming a debtor of 51%. This is an average statistical contract of a customer who regularly pays bills and has an average value of consumption for a given region of service provision.

With the help of a forecasting system, it is determined under what conditions the contract will enter the zone of risk. With an increase in consumption from 7950 to 13800 kW, the probability of becoming a debtor is 73%.

What do utilities gain from ML debt recovery and debt prediction models?

A. The advantages

- Rapid Integration and Flexibility: Such a machine learning model for predicting debts comes with an architecture that allows for quick and seamless integration into existing systems via a RESTful API, ensuring minimal disruption to operational flow.

- Data-Driven Analysis: With the capacity to analyse customer data over any specified period, the model affords utilities a detailed and accurate assessment of risk across their customer base.

- High Accuracy: The high accuracy of predictions equates to more effective targeting of at-risk customers, enabling preventative measures to be implemented more efficiently.

- ‘What-if’ Scenario Planning: A core feature of the model is its ability to conduct ‘What-if’ simulations, providing decision-makers with a dynamic tool for detecting anomalies and assessing the potential impact of different strategies.

B. Business Value

- Revenue Protection: By accurately identifying accounts with a high risk of default, the model plays a pivotal role in mitigating bad debt and preserving the utility’s income.

- Healthier Cash Flow: With improved consumer debt management, utilities experience a more consistent and reliable cash flow, bolstering the overall financial health of the organisation.

- Regulatory Compliance and Customer Support: Predictive insights bolster proactive customer engagement, aligning with regulatory directives to prioritize consumer welfare and mitigating financial risks without relying on burdensome deposit requirements.

Top 5 web-based debt collection software

MaxBill

MaxBill’s utility debt management software provides a comprehensive solution designed to address the critical challenges of debt recovery in the utility sector. Combining advanced machine learning models, automation, and configurability, MaxBill equips utilities with the tools needed to enhance debt collection efficiency and manage customer relationships effectively.

Main Features

Machine Learning-Driven Debt Prediction Model

- Accurately identifies contracts at high risk of accruing future arrears.

- Analyses key factors contributing to customer debt formation.

- Implements ‘What-If’ modelling for strategic forecasting and decision-making.

- Provides insights into the most effective actions for collecting consumer debt.

Automation and Configurability

- Automates communication activities, collection processes, and reporting.

- Configurable workflows tailored to different customer segments and business rules.

- Enhances operational efficiency by reducing manual intervention.

Comprehensive Integration

- Seamlessly integrates with existing utility and energy billing systems.

- Utilises open APIs for easy integration with industry-leading applications.

- Centralises customer data to inform and optimize decision-making.

Advanced Reporting and Analytics

- Delivers real-time reports to assess performance and evaluate strategies.

- Provides insights into customer conditions and debt patterns.

- Supports proactive engagement strategies based on data-driven analysis.

Customer-Centric Approach

- Tailors debt recovery workflows to suit individual customer needs.

- Incorporates creditworthiness checks and personalised payment plans.

- Utilizes a robust reminder and alert system for effective communication.

- Machine Learning Debt Prediction Model: Leverages machine learning to predict customer debt risks and personalize debt recovery strategies. By analyzing historical data and consumption patterns, the model helps utilities understand customer behaviour and proactively address potential debt issues, ensuring tailored and empathetic solutions.

Role of Machine Learning in Addressing Bad Debts

Accurate Risk Identification

- The machine learning debt predictive model identifies accounts at high risk of default, allowing utilities to prioritise and address these accounts proactively.

Enhanced Decision-Making

- By analysing historical data and consumption patterns, the model provides actionable insights that help utilities develop targeted strategies for utility debt recovery.

Predictive Insights for Proactive Measures

- The model uses predictive analytics to forecast potential future arrears, enabling utilities to take preventive measures before debts escalate.

Optimised Recovery Strategies

- Through ‘What-If’ simulations, utilities can test various scenarios and determine the most effective approaches for utility debt recovery, ensuring optimal financial outcomes.

Increased Efficiency

- The ML model automates complex analysis and reporting tasks, reducing the burden on human resources and improving overall operational efficiency.

Exus

EXUS Collections is an advanced debt collections software designed to revolutionise customer service within the debt management industry. Leveraging cutting-edge technology, this software transforms debt collection from a stressful process into a cooperative and consumer-friendly experience.

Main Features

Comprehensive Debt Lifecycle Support

- Automates routine processes and tasks.

- Facilitates customer interaction through both traditional and digital channels.

Powerful Decision-Making Engine

- Driven by business rules and analytics.

- Incorporates a rich set of metrics without the need for custom development or ongoing IT support.

High Configurability

- Easily adapts to changing business environments and regulatory requirements.

- Supports centralised and distributed organisational structures.

User-Friendly Interface

- Intuitive and streamlined for ease of use.

- Supports multiple debt types, including retail and corporate.

Extensible Database

- Accommodates unique data requirements.

- Flexible data import module for building complete customer profiles.

Advanced Reporting

- Provides rich, out-of-the-box reports.

- Includes ad-hoc design capabilities for customised reporting.

Strategy Design and Assessment Tools

- Intuitive strategy design tool for creating and testing collections strategies.

- Integrated scorecard tool, budgeting, and costing module.

- Champion/challenger functionality and simulations for enhanced decision-making.

360° Customer View

- Configurable agent interface to streamline collection activities.

- Enhances agent productivity and facilitates optimal outcomes for debtors.

Third-Party Collaboration

- Seamless integration with Debt Collection Agencies (DCA) as if they were in-house agents.

C&R Software

C&R Software offers a transformative approach to debt collection and recovery for the utilities industry through 100% configurable, cloud-native platforms. Designed to integrate seamlessly with various systems, C&R Software emphasizes a human-centered methodology that enhances collections performance by leveraging real insights.

Main Features

Humanized Collections Approach

- Utilizes real insights to guide personalized treatment paths.

- Orchestrates analytical approaches to handle exceptions efficiently.

- Empowers collections teams with intuitive user interfaces, improving work processes and reducing churn.

Self-Service and Self-Curing

- Data-driven rules engines and segmentation AI drive configurable workflows.

- Promotes self-curing through seamless integration with communication channels.

- Facilitates omnichannel collections for increased debtor engagement.

Comprehensive Industry Support

- Centralizes customer data to inform and optimize decisions.

- Deploys rules and decision engines to optimize treatment paths.

- Supports large and prestigious utility companies in transforming their debt collections and recovery operations.

Integrated and Connected Systems

- Easy integration with legacy systems and API-based communications.

- Streamlines infrastructure to enhance digital capabilities.

- Aligns systems and tools for modern technology adoption.

Cloud-Native Environment

- Provides a resilient, scalable, manageable, and fast platform.

- Supports hybrid working environments for remote team collaboration.

- Ensures perfect alignment of systems, people, and infrastructure.

Insight-Driven Decision Making

- Builds a comprehensive understanding of customers.

- Optimizes treatment paths and decisioning processes.

- Tailors offers across the entire debt cycle based on generated insights.

Cogent

Cogent Software provides robust solutions for collections and case management, designed to enhance the efficiency and automation of accounts receivables processes. With a focus on simplifying the collections process and empowering consumers through self-service portals, Cogent’s web-based and mobile applications offer a comprehensive and user-friendly approach to debt management.

Main Features

CogentCollect

- Legal workflow and automation for accounts receivables.

- Simplified web-based interface for managing collection accounts.

- Designed for organizations prioritizing the collections process.

CogentConnect

- Self-service debt management portal for consumers.

- Enhances debt collection efficiency and empowers consumers to manage debts easily.

Real-Time Analytics

- Intuitive charts, dashboards, and trend analysis.

- Provides real-time analytics tailored to specific firms, agencies, or individual needs without heavy reliance on developers.

Cogent MobileApp

- Seamlessly integrates in-office and remote access to information.

- Features include previewing documents, opening claims, searching claims, adding comments, and reviewing notes.

- Utilizes face recognition and biometric authentication for secure, fast access.

Technology and Compatibility

- Microsoft compatibility and open database integration.

- Future-proof design with strong security measures.

Debtmaster®360 Software

Debtmaster®360 is a revolutionary collections and contact management platform designed to transform the way businesses handle debt recovery. With unmatched industry integration and a centralized hub for all essential data and tools, Debtmaster®360 enhances profitability and efficiency in debt management.

Main Features

Unmatched Industry Integration

- Connects effortlessly to top-tier industry leaders such as Applied Innovation™ for client portal integration, REPAY® for real-time consumer payment portal integration, and Solutions by Text (SBT) for advanced SMS messaging.

- Serves as a centralized system of record, bringing innovation to your agency.

360° Collections

- Consolidates collections and phone system-related data into one integrated platform.

- Enables collectors to track customer interactions, manage payment plans, and ensure compliance with ease.

- Significantly increases collector contact and payment rates.

Effortless Collections Management

- Manages all aspects of the collections process in one place, from customer data and payment accounting to communication logs and performance metrics.

- Simplifies the collections workflow, making it more efficient and effective.

Comprehensive Support

- Comtronic Systems provides sales, service, and support, acting as a one-stop vendor for all your needs.

- Ensures easy growth of your business into an efficient and profitable operation.

Final Words for Business Leaders

MaxBill’s debt prediction model comes as a stand-alone solution, besides its flagship utility billing solutions. If you are seeking a solution to enhance your debt collection efficiency proactively by forecasting and minimising bad debts and associated costs, please reach out to our team of debt prediction specialists.

Join Our Webinars and Transform Your Business Today!

Are you ready to take your business to the next level? At our exclusive webinars, MaxBill professionals share the knowledge and expertise we have now as a B2B billing and CRM company for utilities and energy, knowledge gained from visiting global Enlit-wise events, 27 years of experience in the field, and successful business cases.

Discover cutting-edge techniques, industry trends, and best practices directly from experts in the field. Whether you’re seeking to boost revenue, enhance customer satisfaction, or streamline operations, our webinars are tailored to meet your needs.

Don’t miss out on this opportunity to gain actionable knowledge and network with like-minded professionals. Join us and unlock the secrets to success!