Updated: August 8, 2025

Efficient utility debt management and collections systems are probably the number one priority for companies in a big debt crisis. Over the years, at MaxBill we’ve seen how single defaults of B2B clients can cause a significant financial impact on utility companies, while B2C overdue payments accumulate quickly, increasing bad debt losses.

As a modern revenue management system provider, we’ve been delivering solutions helping energy and utility companies address indebtedness with different scenarios. So, in this piece, you will get to know:

- Why debt management is simply a must

- Factors that lead to debt management issues

- Ways of debt recovery and debt collection

- What’s your next big step to address bad debts

Key Takeaways

- Businesses relying on manual debt management experience the daunting task of running diverse customer bases, each with unique debt collection needs.

- Effective debt management and utility debt collection strategies encompass flexible debt collection, efficient communication, and technology to streamline debt recovery operations.

- The strategies are attainable with advanced utility debt management technology that embraces automation, configurability, and a powerful reminder system.

- The debt management and collections system is a part of the MaxBill utility billing software.

- Utilities can establish multiple workflows for debt management, catering to various schemes, customer groups, and predefined intervals based on specific business rules.

Why we address utility debt management issues and promote debt recovery?

Utility debt collection comes as a go-to measure under conditions of what people are being through this very season. As gas and energy prices surge alongside the rising cost of living, consumers in Europe cannot or do not pay their utility bills.

The financial and credit control departments within utility organisations are obliged to navigate between revenue requirements and social responsibility, spurred by government initiatives.

Furthermore, businesses relying on manual debt management processes experience the daunting task of managing diverse customer bases, each with unique debt collection needs. Customer service representatives and debt managers must adapt their approaches accordingly, catering to the specific requirements of individual debtors.

Fortunately, effective debt management and utility debt collection strategies can help mitigate the impact of indebtedness while creating a win-win situation for both suppliers and consumers. These strategies traditionally encompass flexible debt collection methods, efficient communication, and technology to streamline debt recovery operations.

Dive in further as we delve into the real-life challenges faced by the sector and explore tangible approaches for optimising debt collection management to minimise the impacts of debt on business performance.

The factors of debt management and collections system crisis

The current debt management crisis plaguing utilities is not an overnight occurrence. It has manifested as a result of multiple contributing factors that have created a perfect storm within the industry. These are

- Cold Weather Risks: With the looming risk of a cold winter, the demand for gas has intensified as it remains the primary source for heating the majority of homes in the UK.

- Limited Gas Storage Capacity: Inadequate gas storage capabilities have left utilities vulnerable to supply disruptions and price volatility. The lack of sufficient storage infrastructure has amplified the impact of market fluctuations, adding to the challenges faced by utilities.

- Global LNG Demand: The soaring demand for Liquified Natural Gas (LNG), particularly from Asia, has created intense competition for gas resources. This surge in global demand has contributed to price spikes, making it increasingly difficult for utilities to manage their financial obligations.

- The impact of the gas price crisis on electricity prices: The most expensive marginal cost of energy sets the entire market price. Despite gas-fired generation accounting for only 40% of energy production, it currently sets the marginal market price at an alarmingly high level.

- Geopolitical Factors: The war in Ukraine has led to a significant reduction in Russia’s gas supply to Europe. This geopolitical tension has disrupted the energy market, compounding the challenges faced by utilities.

To successfully overcome the complex challenges that come prior to utility company debt collection, the utility sector needs a strategic and all-encompassing approach to handling indebtedness, which inevitably includes a debt management solution for consistent utility debt recovery.

Company executives if willing to build a customer-centric utility organisation must reevaluate conventional debt collection methods, which often rely on a generic, one-size-fits-all approach and consider a segmented one, backed up with automation, a certain level of configurability, and efficient ways to communicate with customers.

Utility debt collection through automation, configurability and excellent communication

To overcome a debt management crisis, utilities must design effective utility debt collection strategies that expand payment options, enhance customer segmentation, streamline collection efforts, and reduce operational costs. These strategies are only attainable with the aid of advanced utility debt management technology that embraces automation, configurability, and a powerful reminder system.

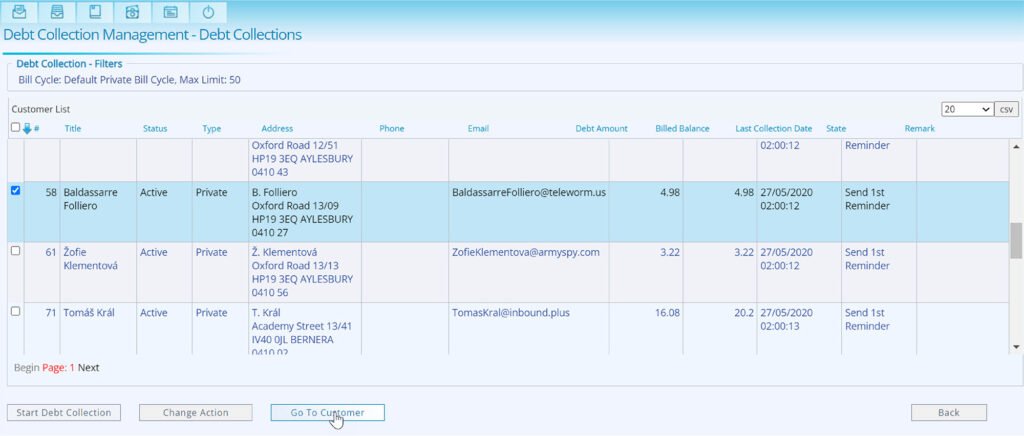

The debt management and collections system is a part of the MaxBill utility billing software. It offers utilities a modern, configurable debt management solution that enables the creation of customer-friendly approaches to collecting growing utility and energy bills. With this solution, utilities can establish multiple workflows for debt management, catering to various schemes, customer groups, and predefined intervals based on specific business rules.

Such configurability creates an environment where both suppliers and consumers succeed: suppliers efficiently manage and recover debts, while consumers stay well-informed and navigate their debt recovery journey smoothly.

Automation may “run the world” of your organisation and utility debt recovery

Automation is a key driver that significantly enhances debt management processes by facilitating communication activities, collection processes, and reporting. Utilities can adopt MaxBill’s debt management approach as a standalone solution, seamlessly integrated into their existing utility and energy billing system, or opt for a comprehensive billing system that encompasses debt management capabilities.

MaxBill’s solution, with its utility debt management and collections system, delivers several compelling benefits, such as:

1. Optimised debt recovery activities: Suppliers simplify the process of transitioning consumers to pre-payment tariffs, facilitating the gradual recovery of outstanding debts. Businesses can also implement tariff plans with various discount schemes, including the ones provided by the government.

In addition, utility debt recovery strategies involve establishing tailored workflows for customers enrolled in payment plans, incorporating predefined stages and business rules to address potential default scenarios.

Furthermore, these workflows consider situations where customers simultaneously receive or make payments for current bills while gradually settling their outstanding debts according to the agreed payment plan.

2. Tailored debt recovery approaches: The system offers the flexibility to design specific recovery cycles for different customer segments, ensuring customized approaches that suit individual circumstances. Workflows can vary based on factors such as residential or commercial customers.

3. Data-driven debt follow-ups: The integration of customer data, including creditworthiness checks through third-party APIs, enhances debt management decision-making. Customer flows can be designed to incorporate verification processes, leveraging data insights to inform appropriate actions.

4. Powerful reminder and alert system: The solution includes a robust reminder and alert system for multiple purposes. Debt collection flows can include reminders with pertinent debt information and due payment dates. Automatic bill copies can be sent to customers in line with the debt management workflow. Additionally, ad hoc alerts notify the credit control team when human decision-making is required.

5. Insightful reporting for improved decision-making: MaxBill’s debt management solution provides real-time reports that empower utilities to assess the performance of activities, evaluate the effectiveness of strategies, and make informed changes or improvements. These reports also offer valuable insights into customers’ specific conditions, allowing utilities to identify trends and patterns and adopt a more empathetic approach to debt collection.

MaxBill’s comprehensive debt management solution equips utilities with the tools and capabilities that utilities can leverage for efficient utility debt collection strategies and debt management in general.

By harnessing automation, configurability, and a powerful system of communication, utilities can enhance their debt recovery efforts, optimise utility debt recovery operations, and foster positive relationships with their customers.

Ready to transform your company’s debt collection and debt management processes? Get in touch with MaxBill today and let us help you deal with financial challenges brought on by the current utility market conditions.

Update: Discover the opportunities that unfold for E&U companies when leveraging the MaxBill debt prediction model.

Join our webinars and transform your business today!

Are you ready to take your business to the next level? At our exclusive webinars, MaxBill professionals share the knowledge and expertise we have for now as a B2B billing and CRM company for utilities and energy, knowledge gained visiting global Enlit-wise events, 27 years of experience in the field, and successful business cases.

Discover cutting-edge techniques, industry trends, and best practices directly from experts in the field. Whether you’re seeking to boost revenue, enhance customer satisfaction, or streamline operations, our webinars are tailored to meet your needs.

Don’t miss out on this opportunity to gain actionable knowledge and network with like-minded professionals. Join us and unlock the secrets to success!