Updated: January 2, 2026

Advanced SaaS billing and CRM for housing cooperatives might be a game-changer for organisations that have been severely affected by the market downturn. In fact, housing cooperatives (bostadsrättsföreningar) in Sweden are passing a test on the resilience of the century-old cooperative housing model, which has traditionally provided stable housing solutions for moderate-income households.

Just to recall, housing cooperatives constitute nearly a quarter of all housing in Sweden. Two major cooperative organizations serve these needs: HSB Riksförbund with 350,000 units and Riksbyggen with 200,000 units.

As of 2022, HSB’s network includes 4,000 cooperative associations that manage 350,000 apartments and 25,000 rental units, with 675,000 active members. Additionally, 125,000 people are saving towards co-op apartments with HSB, collectively contributing about 4.8 billion kronor (nearly USD 500 million).

Nowadays, we see increased costs making homeownership less attainable for many. The Real Estate Price Index for one- or two-dwelling buildings in Sweden increased to 944 points in the third quarter of 2024, up from 923 points in the previous quarter.

In the meantime, a slowdown in new housing developments exacerbates the shortage of available homes. Preliminary figures show that construction of approximately 20,950 dwellings began in the first three quarters of 2023, a 55% decrease compared to the same period in 2022.

The situation is not new to the world. For example, the housing associations in the UK are in the middle of the housing crisis with a significant lack of available housing solutions for vulnerable households.

From a financial perspective, the housing sector is struggling to maintain its traditional social purpose with the pressure to increase its financial and development capacity, which requires going beyond standard charitable schemes.

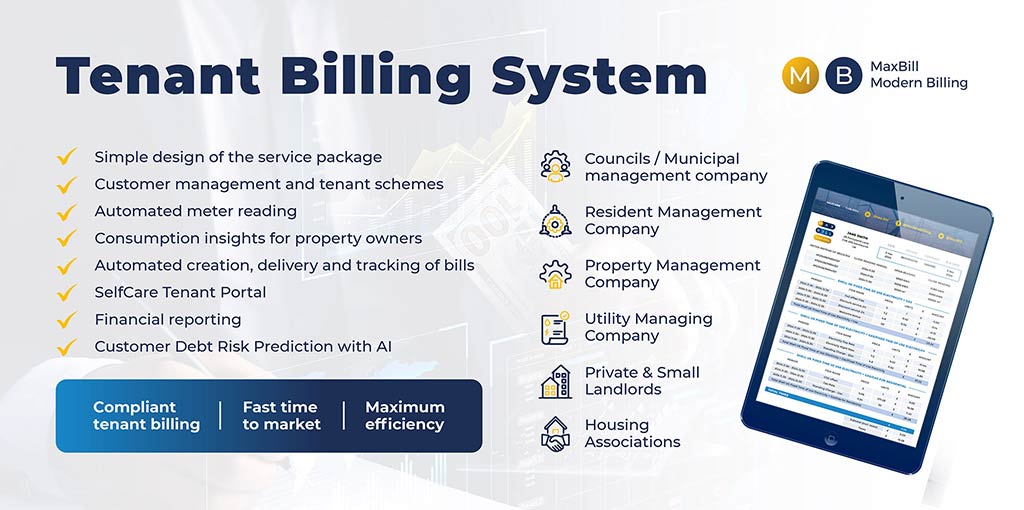

At MaxBill, these factors make us believe that billing systems for housing cooperatives should not just cover a basic social housing model. They also need to support the business models that help sustain their ‘housing mission’.

In this piece, we’re exploring how comprehensive SaaS billing platforms help Swedish housing coops level up with financial performance, affordability and customer-centricity, regardless of existing challenges.

Automated revenue management and efficient debt-collection strategies

Revenue generation in bostadsrättsföreningar is primarily executed through initial capital contributions (basic fees or down payments) from members and annual fees.

When individuals join a housing cooperative, they make an initial payment, often financed through mortgage loans. The process might be streamlined when leveraging automated revenue management system with robust CRM and billing capabilities.

Some housing cooperatives may occasionally rent out commercial spaces or unused apartments (if available), generating supplementary income to support the cooperative’s financial stability.

The good news is that nowadays advanced SaaS tenant billing for housing cooperatives with robust revenue and invoicing capacities allows managing these streams within one comprehensive system. Coming from a telco background, they allow to run various business models and manage revenue streams ‘under one roof’ thanks to their multi-play nature.

Supporting andra hand (rerenting) if bostadsrättsförening approves

Waiting lists for housing cause second-hand leases. Recently the law has greenlighted the opportunity for members of the Bostadsrättsförening to rent their apartments to other people and charge them for all the expenses related. Such a complex structure needs a comprehensive billing approach where automated revenue management and reconciliation can be a game-changer for financial performance.

Addressing debts with a complex SaaS billing approach

Swedish housing cooperatives often carry a significant level of indebtedness. The key reasons are the initial capital required for property acquisition and development. Debts also come from ongoing maintenance and improvements. Each cooperative typically takes on loans at the organizational level, which the members collectively repay through their annual fees.

Members are indirectly responsible for this debt since it impacts their monthly fees, but they are not personally liable for the cooperative’s overall debt. The structure allows for collective ownership and shared financial responsibility, which can sometimes result in high debt levels, particularly if property values fluctuate or interest rates rise.

Today, comprehensive tenant billing and revenue management SaaS platforms include efficient debt management and collection strategies. It means that organisations can address indebtedness in a way that creates a stress-free debt covering both bostadsrättsförening and members.

Automated change of tenancy with advanced SaaS billing for housing cooperatives

We’ve had a client of ours that came with issues related to backdated Change of Tenancy (CoT) processes, affecting efficiency and customer satisfaction. Traditionally, organisations face delays due to cumbersome interdepartmental coordination and inefficient CRM systems.

Now, the Change of Tenancy (CoT) process takes a mere 15 minutes per case, which is significantly faster than their previous CRM system performed.

To sum up, if tenant move-ins and move-outs are something that sabotages the satisfaction of residents, then there’s definitely room for improvement in this area!

Supporting any type of contract fulfilment with SaaS billing and CRM

Membership agreements and service contracts are the two most common consents of Swedish housing cooperatives. Individuals enter into contracts with the cooperative association, outlining rights and responsibilities, including maintenance obligations and participation in decision-making processes.

Cooperative associations may enter into agreements with their parent organizations (e.g., HSB or Riksbyggen) for services like property management, maintenance, and administrative support.

However, we often see how housing organisations go beyond conventional business models that necessitate additional agreements.

The key moment here is that any contract, whether with a member, a parent organisation, a supply chain partner, or any other third party, its complete management and execution are performed with one powerful automated SaaS billing system for housing cooperatives. This eliminates challenges like late payments, errors in billing, and the administrative workload on cooperative boards and contributes to healthier cash flow.

Multi-play nature of complex billing for extra services within the housing model

We see the biggest housing associations in the UK exercising non-core value-added activities to increase their financial capacity. In Sweden, housing solutions can also include the provision not just of gas, water and electricity but also mobile and telecoms. These are extra services that can come under one bill for residents.

The multi-play nature of billing can cover it all, meaning that any type of service package (e.g., bundled one) can be delivered to tenants and processed within one billing and CRM system.

Virtual CSR and self-service portal for positive tenant experience

Tenant experience or rather positive digital tenant experience is a new keyword today when it’s about the housing sector. To deliver on this, housing organisations embrace automated technologies.

Great examples are the integration of virtual Customer Service Representatives (CSRs) and self-service portals. Virtual CSRs interact with customers, reducing the load on call centers, while self-service portals host information about residents’ energy consumption, rent, and service charges.

At MaxBill, we offer both. To mention, a virtual CSR (chatbot) is AI-driven and delivers meter readings updates, bill tracing (in case residents cannot understand the invoice), and even a financial report detailing payments, receipts, and invoices (upon request).

Compliance in a highly regulated market of Swedish housing cooperatives

Swedish housing regulations are generally stable, with updates introduced gradually rather than frequent, sweeping changes. Adjustments are often made in response to economic conditions, housing supply issues, or sustainability goals. For example, earlier a member of a Bostadsrättsförening could only charge their tenants for the monthly fee. The law has changed allowing to charge the tenants for all the expenses for the living spaces.

However, the regulatory framework remains largely consistent over time to provide predictability and security within the housing sector.

MaxBill helps housing organisations stay compliant with regulations and standards to meet the regulator’s requirements to maintain overall financial health, operational effectiveness, and customer satisfaction.

Are you looking for a modern billing and CRM for your housing organisation? Reach out to our pros now and tell us how we can help!

Join the webinar “Sweden: Trends Driving Revenue in Energy & Utility in 2025”

You’ll get meaningful insights into what’s coming in the Swedish energy and utility sectors in 2025 and will definitely identify potential business opportunities or paths to evolve with your services or products.

The event is free.